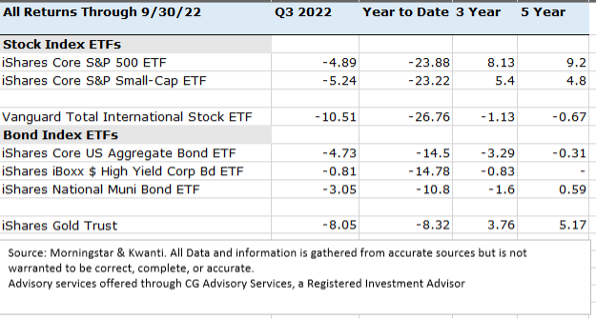

The third quarter of 2022 was another challenging time for most investors. US stocks, international stocks, and US bonds all had declining prices. The root issue is still inflation. While the government is doing what it can to curb inflation, raising interest rates can only slow demand. Fixing supply chains takes much longer, and requires cooperation between Congress and the private sector. We are seeing glimmers of light on this front with several new computer chip factories breaking ground in the US. It will still take years before we see those chips in your smart phone.

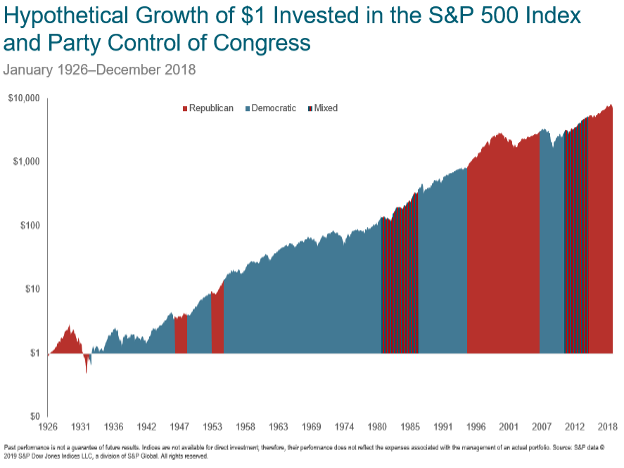

We are just weeks out from a Mid-Term Election. While these tend to be less noisy than presidential elections, we are seeing the typical barrage of smear ads about various candidates. Our investment committee finds no conclusive evidence of one party being better for investment markets than the other. You can see the performance of the S&P 500 color-coded by congressional majority. Apple, Inc. was founded in 1976 and has grown to a value greater than $2 Trillion across red, blue, and purple timeframes.

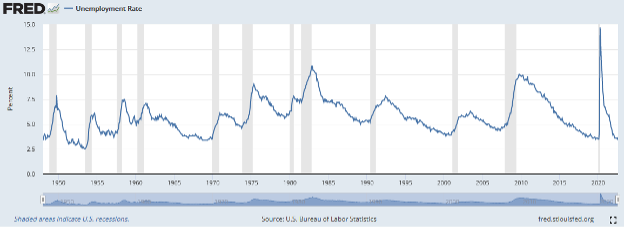

“Two quarters of falling GDP mean that we are in a recession” has become common knowledge. Unfortunately, that is not true. While we never had two consecutive quarters of falling GDP and not been declared to be in a recession, recessions are declared by the National Bureau of Economic Research (NBER) somewhat discretionarily. They focus on several attributes of an economic slowdown, one of which is the Unemployment Rate. Unemployment tends to spike during recessions, as you can see by the shaded areas (recessions).

Does it really matter?

Probably not. Stocks regularly fall before a recession has started and begin to gain before it is over. The current bear-market that we are experiencing suggests that we can expect to be in a declared recession eventually. The recession being declared does not tell us much about the future direction of stock markets.

So, what should we do?

Practice discipline and stick to your financial plan. We all experienced the euphoria of a bull-market over the previous decade. This is a natural part of normal market moves. We should not choose our investment based purely on how much money was made or lost over the previous year. Rather a long-term plan based on your actual needs is usually the best choice.

Studying previous recessions and stock market reactions, we observe that more-than-not the market rebounds quickly following them. At the conclusion of four out of the last five recessions, the S&P 500 gained greater than 10% in the year immediately following. Staying invested has historically been a good strategy.

Securities offered through Geneos Wealth Management, Inc. Member FINRA/SIPC.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor.

‘Past performance does not guarantee future results. Investing involves risk, including the loss of principal.

‘The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value.

‘Neither Asset Allocation nor Diversification guarantee a profit or protect against a loss in a declining market. They are methods used to help manage investment risk.

Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained directly from the Fund Company or your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.