The first quarter of 2024 built on the gains that US stock markets enjoyed during 2023, with the S&P 500 Index eclipsing it’s previous all-time high. Gold shined bright again, achieving new highs also. The US Aggregate Bond Index did not participate in the price increases. Previous hopes of interest rate cuts did not materialize yet, which contributed to the falling prices of many bonds.

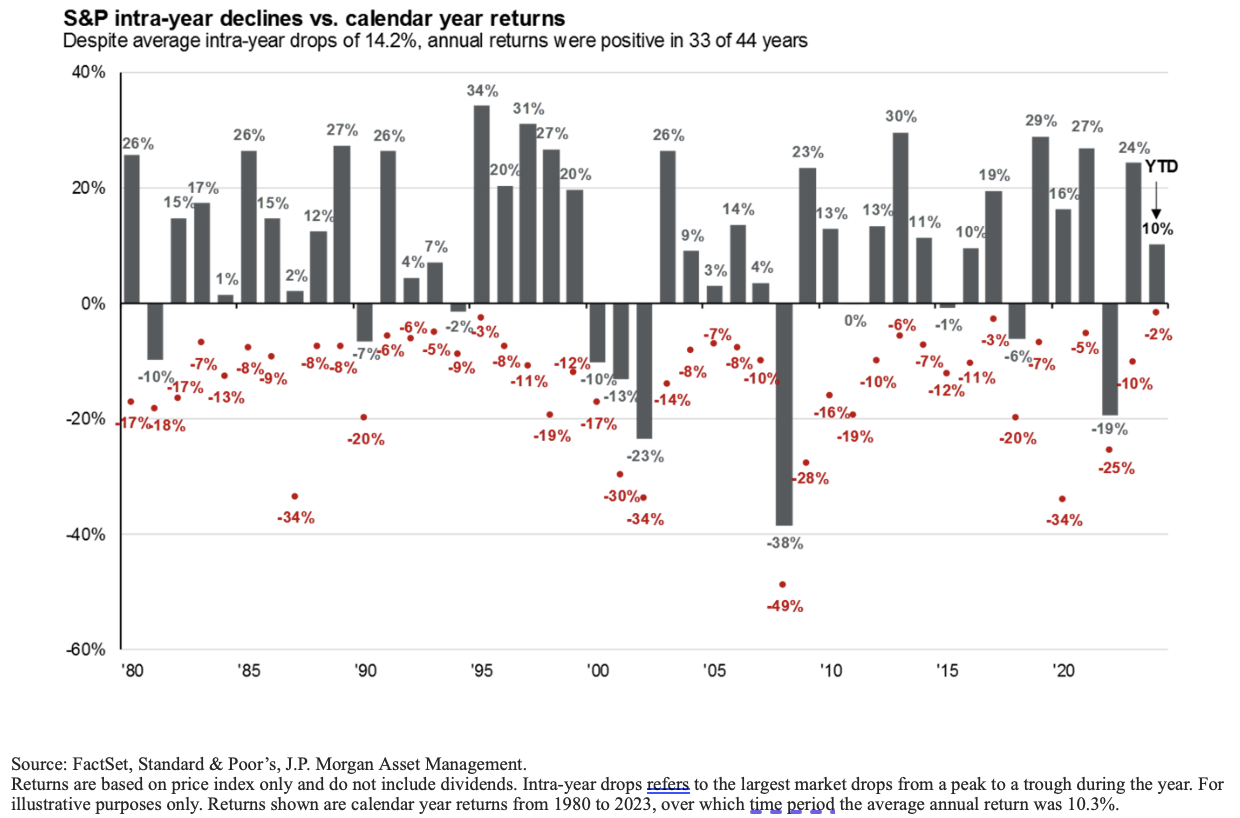

It is healthy to reflect on the truths of investing when we see large moves to either the upside or downside. It is perfectly normal to have bouts of volatility even in positive market years. Below is a chart from JP Morgan showing the calendar year return for the S&P 500 Index and worst drop in the market during each of those calendar years. We enjoyed positive returns in 2023, but there was a point where the S&P 500 Index dropped 10%. In fact, that is a more common occurrence than not. We should expect a bumpy ride enroute to our long-term destination.

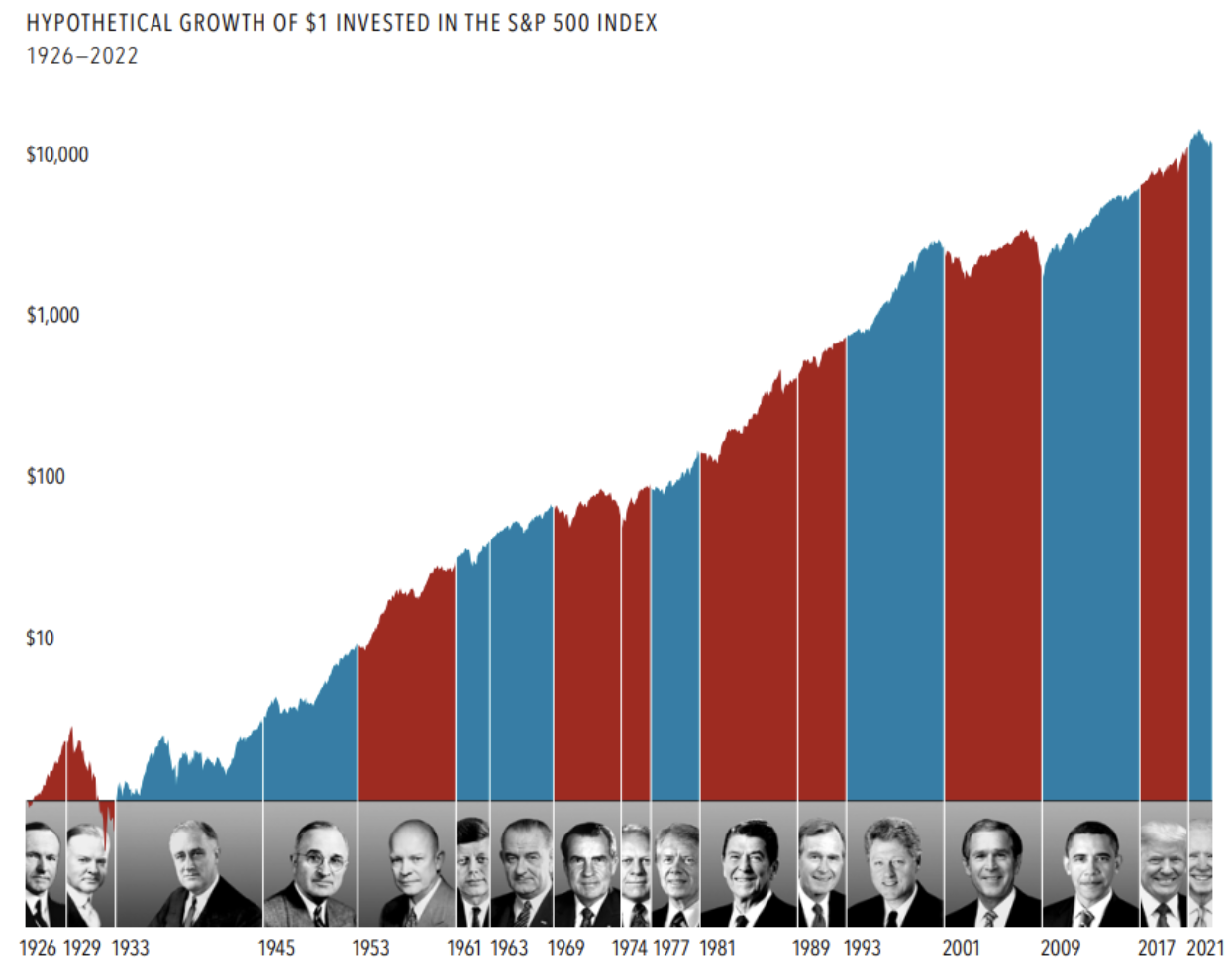

Political regimes, whether they swing left or right, often bring with them a degree of uncertainty. Investors may find themselves grappling with questions about the potential impact of new policies, regulations, or geopolitical tensions. It’s natural for these uncertainties to create a sense of unease and prompt investors to reconsider their strategies.

We don’t find convincing evidence that one party is better for markets than another, and thus do not make decisions about how much should be in stocks vs bonds (or other assets) based on a president. Of course, this isn’t to say that political developments should be ignored altogether. We do actively monitor shifts in the economy to align our investment strategies with longer term developments.

Below you can see a graph of the S&P 500 Index returns color coded by presidential party. The only discernable patterns that can be observed are it goes up more than down, and that the color doesn’t make much difference.

Instead of reacting impulsively to political news, investors are better served by focusing on factors within their control, such as asset allocation, diversification, and staying true to their long-term financial goals.

So, what should we do?

As always, we recommend a sober approach to investing while practicing diversification. Have a long-term plan, stay disciplined, and monitor for structural changes. We cannot control the direction of stock markets, nor the outcomes of elections. What we can do is ensure that financial plans are in good order and our investment strategies match.